During last two Diwalis we have discussed two stocks that supports two different mega trends. This year also let us discuss one such stock , that I believe will lead in the forefront of an emerging mega trend .

Ageing is a reality and nobody can escape from this . Nowadays

rhythm of life changed a lot and everyone is running behind something that we

can’t even define. In our society, even if people making more than enough money, lot of people facing the issue of finding enough time to care their parents.

This is where the potential of Senior Care business lies. The senior care

market is still at a nascent stage India. As per a 2019 report by consultancy

firm McKinsey ,17% of the seniors in India are living alone and I believe this

number will increase drastically going forward considering the changing socio-economic

situation, increase in the number of nuclear families , improving

life expectancy that results in increasing senior population in the

country etc. Migration of younger generation to foreign countries and unwillingness of their parents to follow the same adding fuel to the loneliness of elders in these days. All these are increasing the business potential of senior care business here . As per Industry analysis, “out of

the 20,000 senior living units in India, about 55% are operational,

while the rest are at various stages of construction. The demand – pegged at

about 240,000 units – is almost 12 times the available capacity” . On the basis

of this background let us look into the only listed company operating in this

sector – MAX INDIA – through its subsidiary ANTARA .

ABOUT THE COMPANY

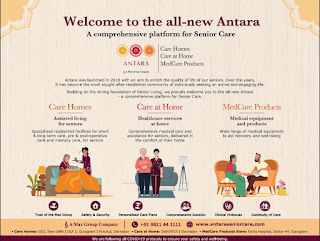

Antara Senior living is offering independent Residences for seniors. First Senior residential community of this division started functioning in a 14 Acre facility at Dehradun with 180 apartments in 2020. Its second facility is under construction at Noida with 340 apartments that is expected to ready for possession by 2025.As per latest update ,Company already sold out 300 units out of 340.

Under the Assisted care division ,it operates Care Homes,

Care at Home, MedCare and Memory care

homes .This division cater to seniors over the age of 55, who need more

frequent interventions in their daily

lives due to medical or age-related issues. I strongly believe there is immense

scope for these verticals due to more than one reasons like the increase in seniors who are attaining an age where they are in

dire need of any type of home care due to increasing life expectancy .

Care homes are specialized residential facilities meant for short- and

long-term care, pre & post-operative care and memory care for seniors.

These assisted living facilities provide primary health care and emergency

response services.

Care at home providing personalised care and attention under the

guidance and supervision of reputed clinicians.

A team of highly trained professionals provides care in the comfort of elder’s

home itself Instead of

taking the sick and elderly people out for their homes for meeting appointments

and treatment. This is bringing the much needed care and services to the home

which is more convenient both for elders

and those who are responsible to provide care to them. In addition to the above

it is a fact that senior home care is a rather affordable route for giving

people the help that they need compared with treating them in a hospital. This

division’s service includes diagnostics, nursing care ,

physiotherapy ..etc

MedCare division providing a

range of medical products and equipments on rent/ sale for the recovery

and well-being of elderly people .

Under the Memory Care homes

division Antara takes care of Dementia patients and assists them in carrying

out their everyday tasks. Recently company

opened its first dedicated residential Memory Care Home in Gurugram for

Dementia patients. Max now planning to add 35-40 more care homes/ memory care homes with a bed capacity of approximately 2000 .

This is the brief business

profile of the company. Since more details are available in company’s website,

I am not going in-depth. ( Link of Investor presentation and latest Conference call provided at the bottom which will help you to understand more about the Industry and specific to the company )

It is a fact that few other

business groups are keenly looking to tap the opportunities in this sector

.But I strongly believe , MAX group is

one of the most eligible business group to run

such a business because of their experience in running hospital/medical

business for decades. In addition to this, company having a treasury Corpus of around Rs.300 Cr

(after recent buy back) and other monetizable assets of worth Rs 160 crore to

fuel its growth going forward and its current market cap is even below the

combined figure of these liquid resources. Promoters didn't participate in the just concluded buy back ,hence their stake in the company increased from 40 % to above 51% .

Conclusion

Once again wishing a Happy Diwali to all my dear friends ...

For more details and Reports , go through the following links.

Antara Company Website Link HERE

Antara Senior living Apartment Video Tour HERE

Max India Investor presentation HERE

Max India Q1 FY 2022-23 Conference call Audio link HERE

Article on Senior Care business LINK1 , LINK2

Discl:

P Above note is prepared only for educational purpose .Part of data used in the above note taken from publicly available sources and credit of the same goes to the original owner . Few sentences are copy pasted without any editing . Personally holding shares of Max India , hence views expressed here may be biased , do own due diligence before taking any investment decision.